In today's fast-paced business surroundings, the ability to process payments effectively and securely is definitely more crucial than ever. Whether you're a small local shop or even a web retailer, browsing through the complex planet of payment processing can be a new daunting task. This particular is where some sort of payment processing realtor steps in, performing as a possible essential companion in order to businesses improve the look of transactions and maximize revenue.

The role involving a payment processing agent goes beyond merely facilitating payments. These people provide valuable insights into the most current trends, security measures, and best apply, ensuring that your organization remains competitive. Through understanding read more to helping a person choose the best payment portal, a knowledgeable agent could be the variation between simply living through and truly booming in the market place. In this article, you will explore typically the many main reasons why joining up with a repayment processing agent is a great move for the business and just how they can uncover the potential with regard to success.

Understanding the Position of Payment Running Agents

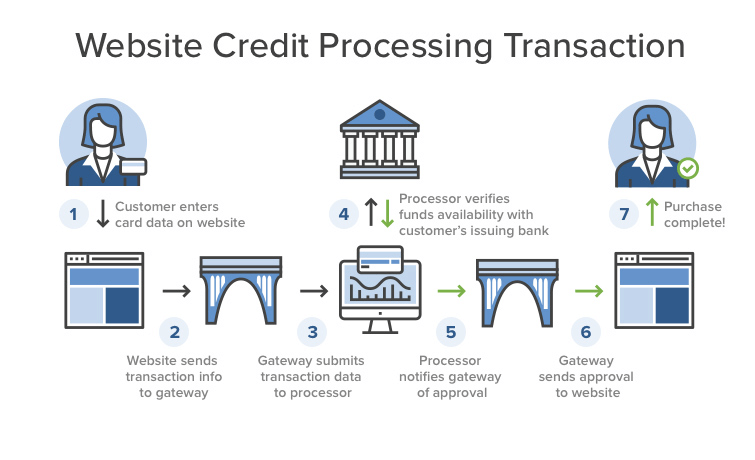

Payment processing agents serve as the particular crucial link in between businesses plus the complex world of digital transactions. https://blogfreely.net/racingcloud87/area-code-success-the-necessary-role-of-transaction-processing-agents assist businesses accept payments through various stations, ensuring that funds are transferred securely and efficiently. By simply learning the specific requirements of their clients, transaction processing agents can easily recommend tailored options that align along with their business designs, enabling smoother transaction experiences.

These agents enjoy a vital function in educating companies about the offered payment processing options, including merchant balances, payment gateways, in addition to mobile payment options. They simplify the technical jargon and even assist businesses inside navigating the best practices for repayment security, compliance, and even overall payment approach. This guidance is usually essential for little businesses to flourish in a competing marketplace, allowing all of them to focus in their core businesses while ensuring their particular payment systems usually are robust and dependable.

Furthermore, payment processing brokers are instrumental throughout helping businesses be updated with appearing trends on the market. Since digital payments advance, agents provide observations into innovative systems and methods that will can enhance transaction acceptance and buyer experience. By leverage their expertise, businesses can not just streamline their payment processes but in addition adapt to modifying consumer behaviors and even expectations, ultimately resulting in increased revenue plus customer satisfaction.

Benefits regarding Collaboration with Settlement Processing Providers

Collaborating with payment processing real estate agents offers businesses a new wealth of advantages that can significantly boost their operations. Settlement processing agents will be expert navigators inside of the complex landscape of financial dealings, enabling businesses to be able to streamline their transaction systems and concentrate on core competencies. By leveraging the particular knowledge and connection with these agents, companies can avoid common pitfalls and ensure they adopt typically the best practices personalized to their specific needs.

Another key gain is access to competitive rates in addition to favorable terms. Transaction processing agents frequently have established interactions with various payment processors and can negotiate better rates on behalf regarding their clients. This kind of not only minimizes costs but in addition allows businesses to be able to allocate resources even more efficiently. Additionally, possessing an experienced real estate agent by your aspect helps in assessing different pricing buildings, such as interchange fees and transaction costs, ensuring of which businesses find the the majority of financially sound choices.

Ultimately, payment processing agents play a crucial function in enhancing customer experience. They might assist businesses implement user-friendly payment solutions, making sure that transactions are smooth and safe. By providing information into customer choices and payment fashion, agents enable companies to adapt to evolving consumer actions. This collaborative strategy ultimately leads to enhanced customer satisfaction and even increased loyalty, cultivating long-term growth in addition to success.

Trends and Way forward for Payment Processing

The surroundings of payment processing is evolving quickly, driven by improvements in technology plus changing consumer actions. In 2024, expect to see a great increased emphasis on mobile payments, with an increase of businesses adopting mobile wallets and handbags and contactless payment options. This switch not only improves convenience for buyers and also allows businesses to cater to a tech-savvy market that prioritizes rate and ease of deals. Payment processing real estate agents must stay informed about these developments to help their own clients adopt the particular right solutions.

Another important trend shaping the future of transaction processing is the growing need for protection. With rising issues about data breaches and fraud, companies will increasingly prioritize solutions that boost security, such as EMV chip technology and end-to-end encryption. Payment processing agents will play a critical role in helping businesses to employ robust security measures while ensuring compliance with regulations, these kinds of as PCI compliance. This give attention to protection will not just protect businesses yet also build customer trust.

Lastly, as elektronischer geschäftsverkehr continues to thrive, payment processing will need to adapt to handle global transactions seamlessly. Consumers expect the frictionless experience no matter of their spot. Payment processing providers should be well-versed in the difficulties of cross-border transactions, currency conversion, in addition to local payment personal preferences. By understanding these types of dynamics, agents can easily help their clients tap into brand new markets and broaden their reach, setting them for development in a increasingly connected with each other world.