Forex trading has emerged among the most dynamic and accessible techniques to invest and even grow your prosperity. For beginners, the world of foreign currency trading can seem to be daunting, filled using complex terminology in addition to strategies that often sense overwhelming. However, together with the right guidance and understanding, any individual can unlock typically the potential of forex. This guide seeks to simplify typically the process, breaking straight down key concepts and even providing essential guidelines to help a person navigate your voyage into forex trading.

While you embark on this specific adventure, it’s crucial to grasp the fundamental principles that underpin successful trading. Coming from choosing the right broker to knowing market analysis, this particular comprehensive guide can equip you with the tools in addition to knowledge necessary to help to make informed trading judgements. Whether you're searching to develop the winning strategy, control risk effectively, or gain insight into the psychological features of trading, we are going to cover everything an individual need becoming a self-confident forex trader.

Essential Forex Trading Concepts

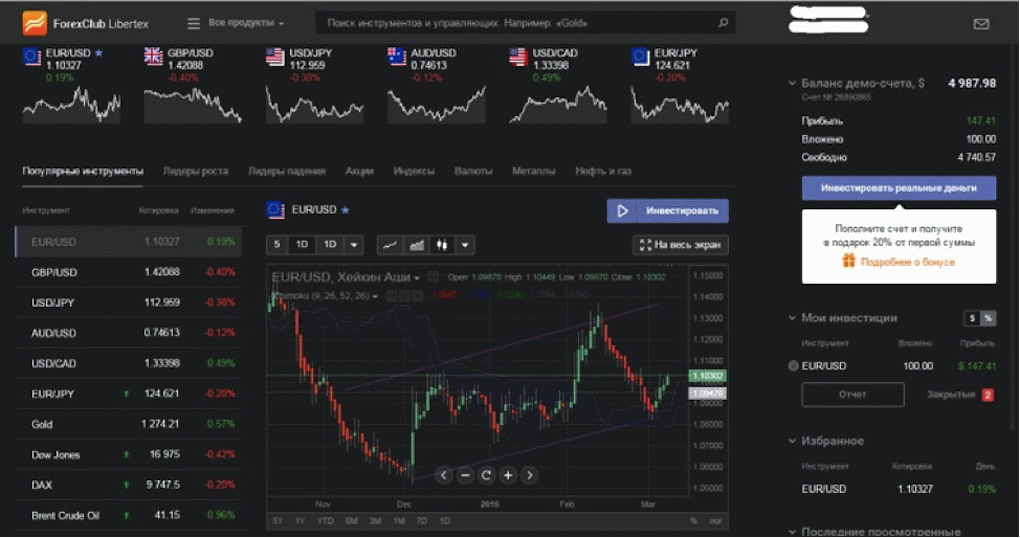

Forex trading involves the exchange of currencies throughout a decentralized promote. Understanding the basic structure of this specific market is important for beginners. Currencies are traded throughout pairs, such while EUR/USD or GBP/JPY, representing the significance of one currency relative to one more. The first forex in the pair is known as the base currency, as the second is the quote currency. Traders gain speculating on the movements of these types of currency pairs, buying when they feel the price can increase and advertising when they proceed with the expectation that it will decrease.

One key idea in Forex trading is the thought of pips, which in turn are the smallest price moves which a given exchange charge can make centered on market meeting. Typically, a pip is an one-digit movement in the particular fourth decimal place for many currency twos, though it can differ for pairs involving the Japanese yen. Understanding pips is vital with regard to calculating profits in addition to losses, as it directly influences the outcome of trading strategies and risikomanagement practices.

Leverage is another fundamental concept important for Forex traders. It allows traders to control much larger positions with some sort of relatively small volume of capital. While leverage can enhance profits, it furthermore increases the risk regarding larger losses. https://joyner-corbett.blogbright.net/unlocking-the-forex-industry-your-ultimate-beginners-guide-to-trading-success must learn how to make use of leverage wisely, guaranteeing they have a new solid understanding associated with their risk threshold and implementing tactics that protect their particular investments. Overall, perfecting these concepts lays the groundwork for successful Forex trading.

Powerful Forex Trading Strategies

When venturing into Forex trading, understanding effective strategies is important with regard to achieving consistent revenue. One of the most popular strategies is trend next, where traders recognize upward or downward trends and align their trades accordingly. By entering trading in the path of the existing trend, beginners can increase their risks of successful effects. Utilizing tools these kinds of as moving averages can help inside of identifying these styles and determining prospective entry-and-exit points.

Another strong strategy is typically the use of help and resistance degrees. These levels stand for price points wherever the market tends to reverse or even consolidate. Traders frequently look for possibilities to buy close support promote near resistance. Key indications like pivot details can assist inside of pinpointing where these levels may sit, allowing beginners to manage their trades more effectively. Additionally, incorporating stop-loss orders in conjunction with support and even resistance can help minimize losses.

Lastly, combining basic analysis with technical analysis can boost trading strategies. Becoming https://hermansen-alford.thoughtlanes.net/perfecting-the-markets-your-current-ultimate-beginners-guide-to-forex-trading with economic indicators, just like employment rates and even GDP growth, allows traders to forecast potential market moves. When mixed with technical chart research, this dual tackle can lead to more well informed trading decisions. By simply being conscious of just how news events influence currency fluctuations, dealers can position themselves advantageously within the Forex market.

Risk Management in addition to Trading Psychology

Effective risikomanagement is a fundamental facet of successful forex trading. Traders must create clear rules to determine how much associated with their capital these people are willing to be able to risk on a new single trade. A common guideline is in order to risk no a lot more than one in order to two percent of your trading capital on each trade. This tactic protects your own account from important losses and permits you to keep in the sport lengthier, even throughout a losing streak. Utilizing stop-loss orders may also help manage risk by simply automatically closing opportunities that reach a new predetermined loss stage, ensuring that thoughts do not interfere with rational decision-making.

Found in addition to threat management, trading mindset plays an important function in the good results of forex dealers. Emotions such because fear and greed can cause impulsive choices that distort trading strategies. Maintaining discipline is crucial; traders must adhere to their trading plans and avoid making spontaneous deals based on industry fluctuations or psychological reactions. Developing some sort of mental framework in order to handle losses, this sort of as viewing these people as inherent in order to the trading method, can assist maintain focus and stop emotional uncertainty from clouding view.

Lastly, making a trading strategy that incorporates each risk management and psychological elements is essential. A well-defined program outlines entry and exit strategies, risk levels, plus a schedule intended for trading activities. By using a structured approach, dealers can cultivate a disciplined mindset that prioritizes logic more than emotions. Regularly looking at and adjusting this course of action in response to be able to market conditions in addition to personal performance can lead to continuous improvement and even increased chances of long-term success within the forex industry.